Welcome to Crisis Credit Solutions

INVEST IN YOUR CREDIT.

INVEST IN YOUR FUTURE.

Join our FREE community with those who are working to achieve their dream life!

Credit Evaluation

We specialize in helping individual and families regain control.

Set a Goal

We provide personalized to credit repair solutions tailored.

Get Results

Our goal is to not only boost your credit score but also empower.

Our program has helped people just like you increase their credit score FAST.

Find out if you qualify in 60 seconds with our quick and easy process!

Our program has helped people just like you increase their credit score FAST.

Find out if you qualify in 60 seconds with our quick and easy process!

Years of Experience

Successful Projects

About Us

Rebuild, Repair & Improve

Your Credit Score!

We specialize in helping individuals and families regain control of their financial future by repairing and improving their credit scores team of experts is dedicated to analyzing your credit report.

Buy or Refinance Your Home

Purchase a New Vehicle

Qualify for a Better Job

Move into a Better Apartment

Our Services

HOW WE IMPROVE YOUR LIFE

Crisis Credit Solutions isn't just another credit repair company. Repairing your credit is half the work, knowing how to maintain and build better credit over time, is the most important part. We provide everything you need to set yourself up for a lifetime of good credit.

Financial Education

We guide you every step of the way to help you build, protect, and maintain a strong credit profile.

Faster Credit Repair

We challenge every piece of negative information every month. This makes your repair process much shorter, saving you money.

Rebuild Your Credit

We help you open specifically-selected, preapproved lines of credit to add positive information to your report, making it easier to get more approvals later.

Credit Management

We help you manage your accounts, balances, and payments to keep your credit healthy, avoid mistakes, and strengthen future approvals.

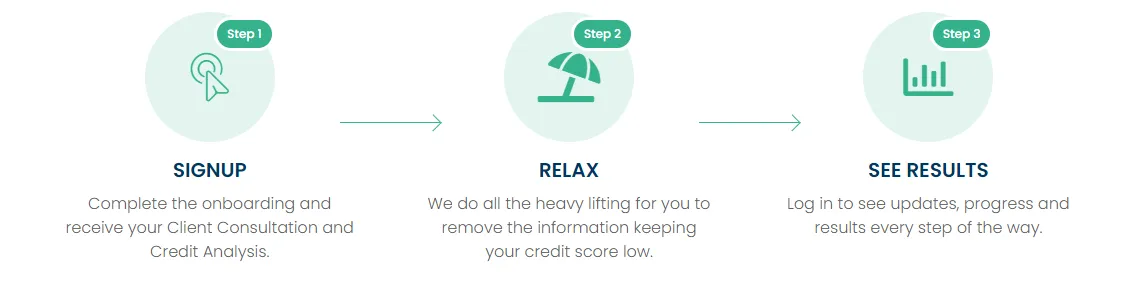

STEP-BY-STEP PROCESS

Getting Started Is As Easy As 1-2-3

We’ve made the process simple and structured, so you always know what to do next without feeling overwhelmed.

SIGNUP

Complete the onboarding and receive your Client Consultation and Credit Analysis.

RELAX

We do all the heavy lifting for you to remove the information keeping your credit score low.

SEE RESULTS

Log in to see updates, progress and results every step of the way.

Why Choose Us

OUR PROGRAM PROVIDES YOU WITH:

The credit FACTS to increase your credit score the RIGHT way...

Little-known hacks to SAVE you money!

Financial literacy that we're not taught in school.

A game-plan to eliminate ALL the negative remarks legally!

SO YOU CAN...

Buy or Refinance Your Home

Purchase a New Vehicle

Qualify for a Better Job

Move into a Better Apartment

Reduce Stress in Your Relationship

Get Approved for Credit Cards (At low rates)

Save Thousands of Dollars a Year

Lower Insurance payments

Lower Car Payments

The BEST Interest rates

Why Choose Us

OUR PROGRAM PROVIDES YOU WITH:

The credit FACTS to increase your credit score the RIGHT way...

Little-known hacks to SAVE you money!

Financial literacy that we're not taught in school.

A game-plan to eliminate ALL the negative remarks legally!

SO YOU CAN...

Buy or Refinance Your Home

Purchase a New Vehicle

Qualify for a Better Job

Move into a Better Apartment

Reduce Stress in Your Relationship

Get Approved for Credit Cards (At low rates)

Save Thousands of Dollars a Year

Lower Insurance payments

Lower Car Payments

The BEST Interest rates

Gonzoone A

Dec 24, 2025

"I never realized how much I could save until I worked with a financial coach. They helped me restructure my budget and plan for future expenses. Now, I have an emergency fund and a clear path to pay off my debt recommend personal finance coaching!"

Pricing Plan

Choose Your Best Plane To

Get Our Services

YOUR EXCELLENT CREDIT SCORE STARTS HERE

Credit Restoration Program

$150 Enrollment Fee

$99 monthly

This plan includes everything you need to repair, manage, and rebuild your credit with expert support:

Personalized dispute strategy

Unlimited rounds of disputes

24/7 Client Portal Access

Coaching on rebuilding

No Contract

Monthly Updates

Couples Credit Restoration Plan

$250

Enrollment Fee

$169

monthly

This plan gives you full access to our credit repair services while helping you save more when you enroll together:

Personalized dispute strategy

Unlimited rounds of disputes

24/7 Client Portal Access

Coaching on rebuilding

Monthly Updates

Save more by working together!

Credit Restoration Program

$150 Enrollment Fee

$99 monthly

This plan includes everything you need to repair, manage, and rebuild your credit with expert support:

Personalized dispute strategy

Unlimited rounds of disputes

24/7 Client Portal Access

Coaching on rebuilding

No Contract

Monthly Updates

Couples Credit Restoration Plan

$250 Enrollment Fee

$169 monthly

This plan gives you full access to our credit repair services while helping you save more when you enroll together:

Personalized dispute strategy

Unlimited rounds of disputes

24/7 Client Portal Access

Coaching on rebuilding

Monthly Updates

Save more by working together!

Pricing Plan

Choose Your Best Plane To

Get Our Services

YOUR EXCELLENT CREDIT SCORE STARTS HERE

Credit Restoration Program

$150 Enrollment Fee

$99 monthly

This plan includes everything you need to repair, manage, and rebuild your credit with expert support:

Personalized dispute strategy

Unlimited rounds of disputes

24/7 Client Portal Access

Coaching on rebuilding

No Contract

Monthly Updates

Couples Credit Restoration Plan

$250

Enrollment Fee

$169

monthly

This plan gives you full access to our credit repair services while helping you save more when you enroll together:

Personalized dispute strategy

Unlimited rounds of disputes

24/7 Client Portal Access

Coaching on rebuilding

Monthly Updates

Save more by working together!

DIY Credit Repair Course

$27

(one-time)

DIY Credit Repair

Course

Full credit education course

Learn how to clean AND rebuild credit

Understanding credit reports & scores

What to dispute, when, and why

Credit building strategies habits Monthly Updates

Best for:

Beginners who want education before taking action.

Basic Credit Repair

$120 Enrollment Fee

$75 monthly

Just the disputes. No coaching.

Monthly dispute processing

Disputes sent to all applicable accounts

Tracking of responses

Credit report review for inaccuracies

Email updates on progress

❌ No coaching

❌ No credit rebuilding strategy

❌ No buying guidance

Designed for clients preparing for approvals , not just better scores.

Best for :

Clients who only want negative items challenged and are not ready for education or rebuilding.

Standard Credit Repair + Rebuilding

$150 Enrollment Fee

$99 monthly

Education + strategy + long-term results

Everything in Basic, PLUS:

Monthly disputes

Credit rebuilding education & resources

Guidance on adding/restructuring accounts

Utilization & payment strategy

Ongoing credit profile review

Email support

This plan focuses on long-term score growth, not just deletions.

Best for:

Clients who want to fix AND strengthen their credit profile for real results.

Premium Credit Repair & Coaching

$200 Enrollment Fee

$175 monthly

Hands-on guidance for serious financial goals

Everything in Standard, PLUS:

Personalized credit building plan

Monthly 1:1 coaching calls

Home-buying readiness guidance

Auto-buying strategy & lender prep

Priority support (text + call access)

Goal-based credit planning

Designed for clients preparing for approvals , not just better scores.

Best for:

Clients actively planning to buy a home, vehicle, or build wealth and want direct support.

Budget & Money Management Setup – $47

Budget & Money Management Setup – $47

Setup – $47

This plan includes everything you need to repair, manage, and rebuild your credit with expert support:

Personalized budget

review

Money habits + cash-flow strategy

Court Summons & Lawsuit Education Support – $57

Setup – $47

This plan includes everything you need to repair, manage, and rebuild your credit with expert support:

Understanding your court paperwork

Help drafting written responses based on provided information

Credit Restoration Program

$150 Enrollment Fee

$99 monthly

This plan includes everything you need to repair, manage, and rebuild your credit with expert support:

Personalized dispute strategy

Unlimited rounds of disputes

24/7 Client Portal Access

Coaching on rebuilding

No Contract

Monthly Updates

Couples Credit Restoration Plan

$250 Enrollment Fee

$169 monthly

This plan gives you full access to our credit repair services while helping you save more when you enroll together:

Personalized dispute strategy

Unlimited rounds of disputes

24/7 Client Portal Access

Coaching on rebuilding

Monthly Updates

Save more by working together!

Getting Started Is As Easy As 1-2-3

Are You Ready to Get Credit

Repair Services?

Credit Repair Questions

Frequently Asked Questions

How does credit repair work?

Credit repair is 100% legal. It works because of a law called "The Fair Credit Act." The FCRA gives you the right to dispute any item on your credit report. If that item cannot be verified within a reasonable time (usually 30 days) it must be removed. Even accurate negative items can be removed or negotiated away. This law is the basis of all credit repair and foundation of our business.

What is the secret to a high credit score?

1.Always pay your bills on time!

2.Don't close old accounts!

3.Don't apply for any new credit!

4.Don't ever use more than 30% of your available credit on each card.

(less than 10% will give you the best results)

Do I need to enroll in credit monitoring services?

Yes, this is a crucial part of the credit restoration process it is not optional. It is where I will be able to see the changes reported to your credit report by the 3 bureaus and dispute based on that. Please make sure you have an active membership through out your credit restoration process. Monthly fee with my link is $24.99.

Do I have a right to know what's in my credit report?

Of course you do. By law, the agencies must give you a free report annually. However those free reports do not contain scores. For credit repair scores we recommend an inexpensive credit monitoring service.

What does Crisis Credit Solutions do to help?

Crisis Credit Solutions helps clients attack their credit damage by challenging inaccurate, untimely, misleading, biased, incomplete, or unverifiable negative items from their credit reports.

Find out if you qualify in 60 seconds!

A quick, no-pressure check to see if our program is right for you.

Testimonials

Testimonials

HAPPY CLIENTS

RESOURCES

Quick, easy-to-follow tools and guides to help you understand your credit, boost your score, and prepare for what’s next.

Credit Boost Cheat Sheet

Understand what impacts your score and

how to raise it fast.

Homebuyers Prep Guide

Get mortgage-ready with this step-by-step guide to buying your first home.

101 Credit Tips

Boost your score fast with

these powerful strategies.

DIY Credit Repair Course

Master your credit. Boost your score. Learn the exact process credit repair companies use — and do it yourself.

Free Credit Building Course

Take Control of Your Financial Future: Build Your Credit with Confidence!

Step By Step Guide

Learn how to take control of your money with our easy-to-follow budget creation guide!

LATEST ARTICLES

Credit Repair

9 Steps to Better Your Financial Health

In this blog, I break down 9 simple but powerful steps to better your financial health. If you’ve ever felt overwhelmed, behind, or unsure where to start - this is for you.

December 08, 2025 • 3 min read

Credit Repair

Smart Spending Habits for When the Economy Gets Uncertain

When the economy feels unpredictable, every dollar matters more than ever. In this guide, we’ll explore smart, practical ways to manage your money, stop..

October 29, 2025 • 4 min read

Credit Repair

Paying Off Collections

Paying Off Collections

Think paying off collections will boost your credit score? Not always. Learn why paying collections doesn’t mean they’ll be removed and what to do before you pay to protect your score

August 01, 2025 • 2 min read

Credit Repair

How to Use Credit Cards Wisely to Rebuild Your Credit

Use credit cards to rebuild your credit and unlock better financial opportunities. ...more

April 07, 2025 • 3 min read

Credit Repair

6 Ways to Level Up Your Life This Year

Here are 6 ways I'm going to level up my life in 2025. If there’s one thing I’m always striving for, it’s improvement.

I’m constantly working toward new goals, pushing myself to new levels,

January 29, 2025 • 3 min read

Credit Repair

The Power of Sinking Funds

Saving money can often feel overwhelming, especially when you're juggling multiple financial goals. That’s where sinking funds

January 18, 2025 • 4 min read

LATEST ARTICLES

Smart Spending Habits for When the Economy Gets Uncertain

“In an uncertain economy, financial peace comes from preparation, not perfection. Start small, stay consistent, and stability will follow.”

When times feel uncertain and every dollar needs to stretch a little further, overspending becomes even more of a struggle.

If you’re anything like me, you can run into the store for just "toilet paper" and somehow walk out with a full cart. Spending on a whim is real, and it adds up faster than we realize.

So how do we cut back, save more, and stay disciplined when the economy is shaky or when we’re working toward big financial goals?

In this post, I’m sharing simple, practical strategies to help you take control of your spending so you can make your money matter, save with purpose, and stay focused on building the future you want.

Smart Spending Habits for When the Economy Gets Uncertain

1. Build a Realistic Budget

A budget isn’t meant to restrict you—it’s meant to guide you.

Start by writing down your income and expenses. Cover your necessities first (housing, food, utilities, transportation), then plan for extras like entertainment or clothes.

If you’ve never done it before, use a simple zero-based budget—every dollar has a job: save, spend, or pay off debt.

Tracking this monthly will show you where your money is really going—and where it’s leaking out.

2. Know Your Spending Triggers

Before you can fix overspending, you have to understand why it’s happening.

Do you shop when you’re bored, stressed, or trying to feel better? Or maybe you spend because it feels like a reward after a long week.

Recognize your “spendencies.” Once you know what triggers your spending, you can make better choices in those moments.

3. Set Money Goals That Motivate You

When you know what you’re working toward, it’s easier to say no to unnecessary spending.

Maybe your goal is to pay off debt, build savings, or finally buy a home.

Write it down. Keep a visual reminder somewhere you’ll see it—like your fridge or phone background—to stay motivated when temptation hits.

4. Track Every Dollar

You can’t control what you don’t track.

Write down or use an app to log every expense, no matter how small. Seeing those daily purchases adds up fast—and helps you stay accountable to your goals.

5. Cut Back on Eating Out

Eating out adds up fast. A $15 lunch five times a week is $300 a month!

Try cooking more at home, packing lunch, or planning special “treat” meals instead of impulse takeout. You don’t have to cut it out completely—just be intentional.

6. Plan Your Meals

Meal planning saves both money and stress.

Pick a few go-to meals, write your grocery list, and stick to it. When dinner’s already planned, you’re less likely to hit the drive-thru.

7. Replace Retail Therapy with Real Habits

Shopping might make you feel good for a moment—but that “high” fades when the credit card bill shows up.

Find better ways to cope: go for a walk, clean, call a friend, or do something creative. Your emotions don’t need a shopping cart.

8. Don’t Fall for Sales

“50% off” doesn’t mean “free.”

If you weren’t already planning to buy it, you’re still spending money, not saving it.

Walk away and revisit it next month if it’s still on your mind (and in your budget).

9. Shop with a List (and Stick to It)

Going to the store without a list is basically asking to overspend.

Write down exactly what you need and ignore everything else. Avoid “browsing”—especially in stores that tempt you the most (looking at you, Target).

10. Automate Your Bills

Set up auto-pay for your regular bills. It keeps you organized, helps avoid late fees, and frees up brain space for more important financial goals.

11. Pause Before You Purchase

If you see something you “just have to have,” wait 24 hours before buying.

Chances are, that urge will fade—and you’ll keep your money where it belongs: in your account.

12. Use What You Already Have

Before you buy something new, check what you already own.

You might be surprised how much stuff you’ve forgotten about. Repurpose, reuse, and get creative—it saves money and helps you appreciate what you have.

Changing your spending habits won’t happen overnight but small, consistent shifts make a big impact over time.

With the economy feeling uncertain, being intentional with your money isn’t just “good practice” it gives you peace of mind. Having a plan, spending with purpose, and knowing where your money is going brings a sense of security that impulsive spending never will.

This isn’t about depriving yourself or never enjoying life. It’s about protecting your future, prioritizing what truly matters, and using your money in a way that supports your goals, not stress.

You work too hard to feel like your money is slipping through your fingers.

Start today, stay consistent, and let intentional spending create stability, confidence, and a life you feel in control of even in an unpredictable economy.

If you're ready to work towards financial success, check out our online store.

Convinced you need a budget now? Schedule a free consultation and we can discuss next steps for preparing a budget plan!

Free Resources For Financial Freedom

Action Now! Propel Your Journey to Success

We specialize in helping individuals and families regain control of their financial by repairing and improving their credit scores.

A professional credit restoration company based in Victoria, Texas that is driven to help consumers repair and rebuild their credit file to achieve credit worthiness.

CONTACT US

QUICK LINK

Subscribe Nesletter

Copyright 2026 Crisis Credit Solutions